2015 State of the Gear Industry Reader Survey

2015 State of the Gear Industry

Reader Survey Results

Gear Technology’s annual State-of-the-Gear-Industry survey polls gear manufacturers

about the latest trends and opinions relating to the overall health of the gear industry.

As in years past, the survey was conducted anonymously, with invitations sent by e-mail to gear manufacturing

companies around the world.

More than 300 individuals responded to the online survey, answering questions about their manufacturing

operations and current challenges facing their businesses. All of the responses included in these results come

from individuals who work at locations where gears, splines, sprockets, worms and similar products are manufactured.

They work for gear manufacturing job shops, captive shops at OEMs and end user locations.

A full breakdown of respondent demographics can be found at the end of this article.

Gear Industry Optimism – A Tale of Two Gear Industries

The gear industry has been a generally optimistic bunch over the last 10 years, with an average of 88% of all respondents indicating some level of optimism about their companies’ ability to compete. Both last year and this year, that optimism was lower than the 10-year average. In 2014, 85% of respondents indicated some level of optimism, and this year only 80% were optimistic. However, when you break the numbers down, you discover that most of the pessimism and undecidedness comes from outside North America. In fact the disparity in outlook between North American respondents and non-North American respondents has never been greater, according to our survey.

This year, 84% of North American respondents were optimistic about their companies’ ability to compete. Outside North America, the number was only 65%.

Employment

Gear industry employment was slightly more volatile than it was in 2014, with a greater percentage of respondents indicating an increase (34.4%) as well as a greater percentage indicating a decrease (33.2%) in their company’s level of employment. But the outlook for 2016 isn’t quite as positive, with nearly 22% of respondents expecting a decrease in employment at their locations (that number was only 12% in 2014).

Significant Challenges

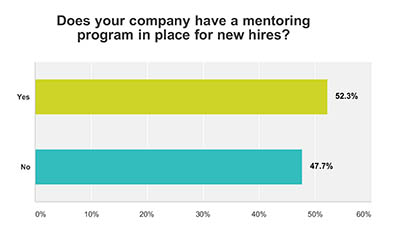

Perhaps more than in any previous survey, our respondents indicated that the difficulty in finding, training and keeping skilled labor remains at the top of their list of concerns.

“ Finding and retaining key talent.”

“ Updating old machines and educating

future gear engineers.”

“ The ability to introduce new suppliers and

equipment to support increased demand.”

“ Adapting new gear cutting technology.”

“ Pass the break even point.”

“ Economy.”

“ Replacing experienced employees that are

near retirement.”

“ Skilled resources.”

“ Finding skilled operators.”

“ Producing higher-cost, more complex

gears.”

“ Employee skills.”

“ Finding new skilled employees.”

“ Sales increases.”

“ Cell implementation.”

“ Skilled labor.”

“ Finding qualified people.”

“ Lean manufacturing.”

“ Meet demand.”

“ Ability to staff for anticipated growth.”

“ Quality and repeatability.”

“ Skilled labor.”

“ Old engineering and manufacturing

philosophies.”

“ Sharing knowledge of experienced workers

with new staff.”

“ New product successsful launching

process.”

“ Hold or increase productivity level.”

“ Finding technical professionals for both

office and factory.”

“ Electing Federal Representatives that

will focus on rebuilding our country’s

infrastructure.”

“ Distortion at heat treating.”

“ Finding skilled labor to replace aging work

force.”

“ Economy.”

“ Cost structure during slowdown.”

“ Increased competition, foreign and

domestic.”

“ Research and development of new

products.”

“ Right sizing for reduced volume.”

“ Bring out new product with lower R&D

spending.”

“ Improving our efficiency and downsizing

for lower sales expectations in 2016.”

“ Finding enough skilled people.”

“ Skilled labor shortage.”

“ Finding qualified personnel to fill

vacancies.”

“ Maintaining a competitive workforce.”

“ How to squeeze higher quality out of older

equipment.”

“ Adding qualified machinists.”

“ Upgrading our equipment.”

“ Implementing more automation.”

“ Finding (or training) skilled labor.”

Skilled Labor

64% of respondents report that their companies are experiencing a shortage of skilled labor. This remains one of the hot topics in the gear industry and in manufacturing in general.

Production Output & Sales Volume

44% of gear industry respondents reported that both production output and sales volume decreased in 2015. These numbers were significantly higher than in 2014 (when 28% of respondents reported decreases in both production output and sales). Many expect to rebound from these decreases in 2016, with only 22% expecting further decreases in production and only 20% expecting further decreases in sales.

Capital Spending

74% of respondents work at locations that spent more than $100,000 on capital equipment in 2015.

46% work at locations that spent more than $1,000,000.

24% of respondents’ companies spent less than last year.

35% of respondents’ companies spent more.

67% of respondents expect to spend the same as 2015 or more in 2016

Demographics

The 2015 State of the Gear Industry survey received responses from a wide cross-section of the gear industry. The breakdown of respondents is shown here.

Thank you to our readers for answer the survey

_400.jpg)

%20ONA_400.jpg)

_400.jpg)

_400.jpg)

_400.jpg)

_400.jpg)

_400.jpg)

_400.jpg)

_400.jpg)

_400.jpg)

_400.jpg)

_400.jpg)