U.S. Cutting Tool Consumption Totals $181.9 million for January

January U.S. cutting tool consumption totaled $181.9 million, according to the U.S. Cutting Tool Institute (USCTI) and The Association for Manufacturing Technology (AMT). This total, as reported by companies participating in the Cutting Tool Market Report (CTMR) collaboration, was down 1.7% from December’s total and up 1.9% from January 2014.

These numbers and all data in this report are based on the totals actually reported by the companies participating in the CTMR program. The totals here represent about 80% of the U.S. market for cutting tools.

“The industrial production index for manufacturing typically leads cutting tool production by one or two months,” said Pat McGibbon, vice president of AMT’s strategic analytics department. “January’s 1.7% decrease in shipments mirrors December’s decline in industrial production. The short lived fall reflected by January’s increase in industrial production leaves us optimistic to see positive cutting tool shipment growth in February and March.”

The CTMR is jointly compiled by AMT and USCTI, two trade associations representing the development, production and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

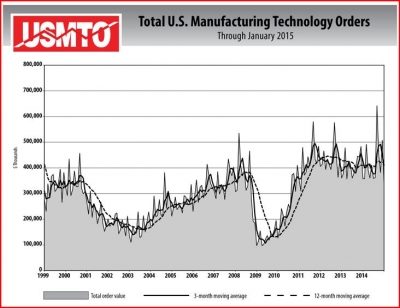

The AMT also reported that January U.S. manufacturing technology orders totaled $341.17 million. This total, as reported by companies participating in the USMTO program, was down 32.9% from December’s $508.57 million and down 4.8% when compared with the total of $358.45 million reported for January 2014.

“To understand why we saw this drop in orders for January, December 2014 saw a sharp increase in sales,” said Douglas K. Woods, AMT president. “This was driven by many end-of-year orders that had been rushed through in order to qualify for tax rebate provisions that were enacted at the last minute for 2014. This is evidenced by the comparatively lower average order value seen in December vs. January, meaning that most end-of-year orders were for less expensive, in-stock machines that could be shipped quickly. The decline wasn’t unexpected, and we still foresee the manufacturing economy keeping on a stable path.”