“We in the Brazilian Industry mainly face the lack of a serious Government with well-defined Industrial policies. Especially in the field of gears, a total absurdity for the Brazilian Government is to tax the gear equipment that we need to import from high-tech countries. This makes us totally uncompetitive with other low-cost countries.”

“The future is for high-quality gears, where the geometrical testing becomes mandatory!”

“High demand in rail and wind power. Expanding with high capex over next 5 years.”

“Agricultural market still extremely down. High inventories and no sign of recovery. Construction equipment lower pace vs 2023 and H1 2024 but still on good numbers. Truck still doing well.”

“Electrification seems to proceed at a slower pace vs the previous years. Tariffs might create important supply chain changes in the future.”

“Global competition.”

“In the second half of 2024, automotive was in decline, gear reducers were stable, other fields (automation, mechanical applications...) showed small growth. No big changes expected for automotive but we see some good signals from other fields.”

“Target and trend in the automotive industry are not clear.”

“Major changes in the automotive industry.”

“High energy prices, high steel prices.”

“AM on the one hand and the ever increasing volumes and advanced technology of EV drive lines is a definite threat to ALL conventional Gear Manufacturing Systems.”

“Ukraine and Russia war.”

“I believe we will see a change in the focus around the EV market. It hasn’t gone well so far, but the push will stop happening in Washington. Mining and oil & gas may grow. Understanding the tariffs. Consumers and how they respond will be interesting.”

“Additive gears. Lightweight gears. New alloy development. Readers should understand the importance of weight vs. strength and mechanisms of strengthening materials. Additional interest is in very high speed gears for supersonic flight.”

“Small gears & electron beam technology.”

“Increased educational opportunities available.”

“Finding trainable individuals that can work 40 hours per week is difficult.”

Car manufacturing has a trend to be supplied more from China, and others are already facing difficulties regarding pricing. Terrible market change if the trend continues for the gear machine makers.”

“On the negative side, competition from India, uncompetitive U.S. steel prices, lack of investment in U.S. steel manufacturing, sustainability of U.S. economic growth against the threat of increasing tariffs. Positive trends include increased use of automation and robotics due to labor cost increases and advancements in AI.”

“Global economies are in the pits.”

“Development of fossil fuel production with the most efficient technical capability of the 21st Century.”

“Inflation and uncertainty of the economy.”

“Too many programs going to India.”

“Gear technology, new gear designs, failure analysis in gear.”

“We see a very important decrease in all industrial sectors.”

“Technology has been stifled with Biden.”

“Labor costs/competition with China.”

“Lack of skilled labor, rising costs, diversification.”

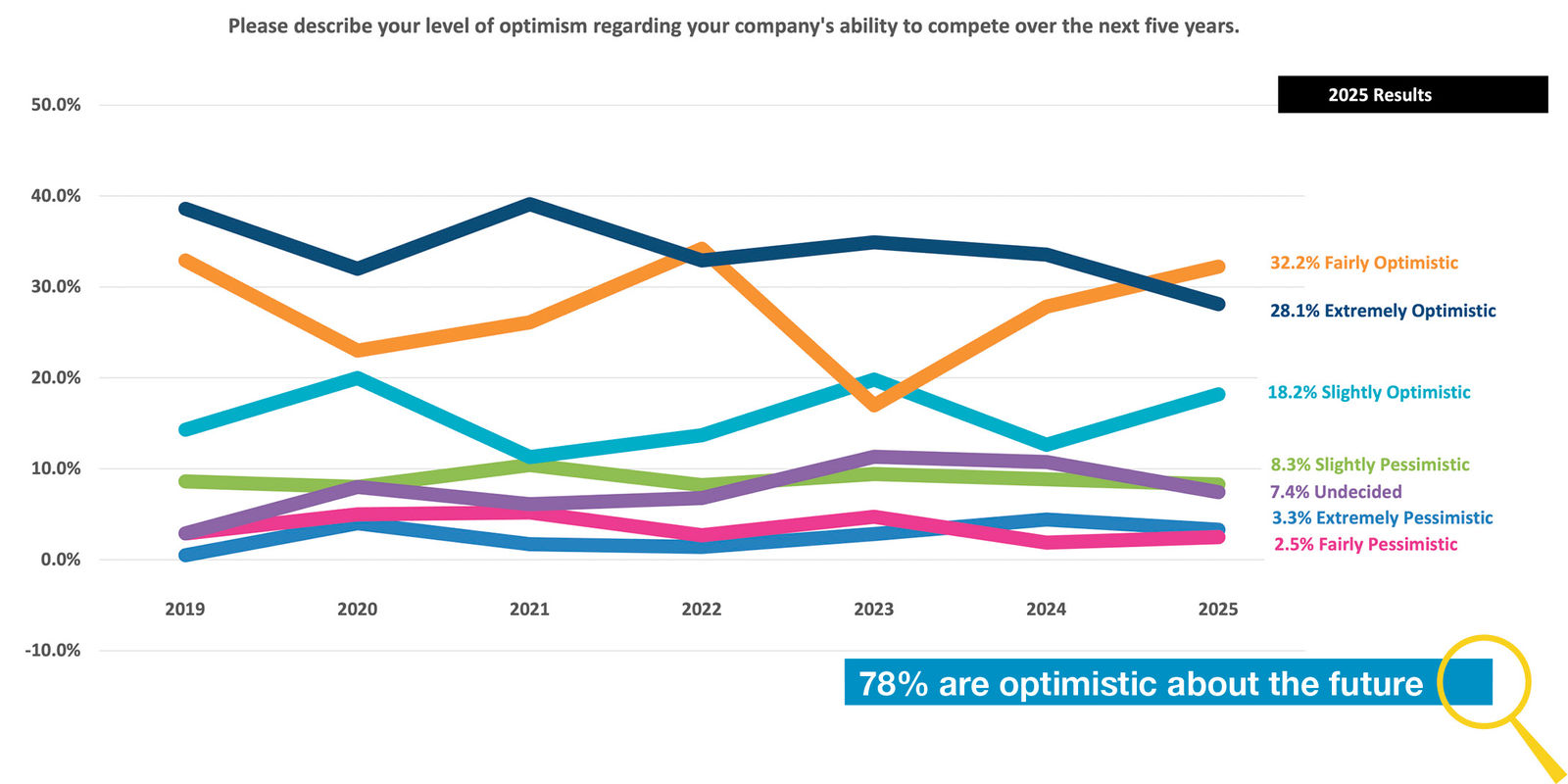

“I believe customer orders will increase due to economic optimism for the future and continuing advances in engineering technology.”

“Workforce development, automation, inflation.”

“Increasing offshore competition.”

“NEV (neighborhood electric vehicle) transmission with planetary drive.”

“Decarbonization of the passenger car industry.”

“Electrification of propulsion systems.”

“Repair of older equipment will be a larger portion of the market because of inflation.”

“Breaking into new hybrid technology markets with government funding. Investments are being made to participate in this emerging market.”

“Business is positive. Finding talent is not.”

“Scrap.”

“Automation and the increasing effectiveness of gear manufacture with 5 axis machines.”

“The growing trend towards automation in industries is leading to an increased demand for precision-engineered bevel gears, as well as improving the durability and performance of gears.”

“Deep discounting by competitors.”

“Impacts of emerging technology on how we conduct business and how we manufacture.”

“Electric vehicle growth, general economic conditions.”

“Reduction or even elimination of the production of conventional transmissions with manual gearboxes.”

“Firstly, the Chinese competition, with machines and labor cheaper than what we have access to. Then, I would say the demand for gears in new mechanical transmissions, or even the replacement of mechanical transmissions.”

“Electrification and decarbonization of manufacturing. Staffing and training—how to find and develop highly capable team members.”

“Gears are the heart of our equipment. The cost of manufacturing medium-accuracy gears is increasing, which is a major concern.”

“Transmission performance increase, efficient gear cutting processes, energy-efficient gear cutting machines, digitalization, process monitoring, new closed-loop manufacturing strategies .”

“Increase in electric vehicles and stagnation of ICE vehicles.”

“New high-quality requirement in EV gears.”

“Robots.”

“New materials, treatments along with need to reduce wear and friction.”

“In my opinion, too much attention is being given to advanced technologies and not enough on learning the basic technologies; everyone wants to run when they can’t even walk.”

“My specialty is large gears for mining. Little work. Other specialty is high precision For defense. Also very little work.”

“Gear noise, plastic materials for gears.”

“Tighter tolerances in gear accuracy. Also, automation even in low volume applications.”

“Hiring qualified personnel to train as machinist.”

“The USA is not competitive with China, Europe, especially eastern Europe, South America.”

“Mergers and acquisitions.”

“Chinese tariffs.”

“Effects in the EV market and a need to expand the ID/OD grinding capacity for gear manufactures.”

“Consolidation.”

“Lack of consistent policy and direction in the EV market. This could be a great opportunity to scale up consistently, but political flip-flopping on policy creates an unpredictable environment that is highly risky to make scale-up investment into.”

“As a machine builder, the trend towards manufacturing gears on lathes and other standard pieces of equipment has affected our business and will likely continue to affect our business in a greater capacity as the ability make better quality gears on lathes is further developed.”

“Tariffs.”

“EV markets.”

“EV and alternate fuel vehicles.”

“Electrification is rolling out at uneven speeds across different industries.”

“EV Market. Scope of the impact for an ICE to EV transition.”

“Economy strength.”

“Decrease in production due to election year.”

“International gear standards..”

“The continued long deliveries of gear processing machines.”

“Gearing in robotics applications.”

“Tariffs. Strong dollar. Available and skilled workforce.”

In what ways has your company implemented AI, and how do you feel about it?

“Document search.”

“We are working on adding it to our CNC programming through software.”

“AI is still in its infant stage in manufacturing.”

“None yet.”

“We have made limited progress using Copilot, but not for internally generated data. It brings benefits for web research and software development.”

“Order processing, options selections—improved the overall time.”

“None.”

“We don’t implement AI yet.”

“In product design and responding to expectations.”

“We are currently in a testing phase in all departments.”

“We don’t have this topic on the agenda, and little knowledge about AI.”

“In the advanced gear metrology field, the AI does not have much to contribute. Most of the software solutions are black boxes.”

“We are in process of implementing AI in our design & technology center.”

“Still working on it. I do not have yet a clear picture.”

“We do not use AI.”

“Production planning.”

“Just chatbot. Not so fearful.”

“Not at all.”

“Not yet. In some areas of analysis and research, it will help the Industry.”

“Only in coding area. We are using AI to improve system management.”

“We are currently using it in creating documents, communication, marketing and research in sales.”

“Doesn’t exist.”

“Not implemented.”

“We are watching what is happening. I have concerns about copyright infringement and accuracy of the large language models required for AI to be of value.”

“Primarily in machine vision in support of final part inspection and internal inventory/part handling and management. I personally feel excited about the prospects of expanding our use of AI across all parts of our organization.”

“AI has selective potential.”

“Have not implemented AI.”

“We have always had robotics. Not sure if AI has caught up to our industry yet to make a difference, but it is coming.”

“Not applicable .”

“At the moment we haven’t implemented inside the company. We think it can be an opportunity for better understanding the market industry variation.”

“Not up to speed.”

“None, and I really do not have an opinion of it as yet.”

“We have not implemented any AI.”

“No implementation.”

“Basic use in database and as digital assistant in meetings.”

“We are developing a qualified database that may be used as the LLM for AI.”

“Minimal usage related to improved internet search tool.”

“Very early stages of using.”

“Not implemented.”

“We have not yet implemented it.”

“Limited use of AI—don’t know enough about it yet.”

“We are implementing custom AI throughout our business and feel that it has a tremendous positive impact on our business.”

“No IA implemented.”

“No, it doesn’t help small businesses at this point.”

“Just for some office jobs like reports, presentation etc. My feeling is neutral so far.”

“We are learning about it.”

“We have not implemented AI and I am feeling rather negative about it.”

“It hasn’t yet. I am glad of this as AI is still in its infancy and poses a huge risk until it is strongly regulated and its datasets are effectively controlled to prevent compounding biases.”

“It is in the beginning stage yet.”

“Still experimentating, it is ok but need to define the use.”

“Only around email, policies, sense checking documents.”

“Marketing and research.”

“I am not aware of any AI projects in my area at this time.”

“None.”

“Prospect mining, feel pretty confident it will pay off.”

“In a bit of automatic drawing.”

“Engineering, HR, marketing, tooling answers, heat treat. Think it’s great!”

“We don’t.”

“None, but intrigued.”

“Simply ChatGPT for productivity improvements. Low level application as of yet.”

“We have had ‘Lunch and Learns’ with IT on ways to use AI in your daily work activities. On a personal level, I use it regularly to solve problems.”

“We occasionally use AI to generate text or summarize web search results. We think most of the problems AI could help us with could also be solved by conventional computing.”

“Limited, but I like it.”

“Very little. Still trying to understand it”

“Only using AI for press releases and other marketing tasks.”

“We have not implemented any AI into our company yet.”

“Nothing tangible.”

How do you anticipate U.S. trade policies in 2025 will affect your supply chain and costs?

“Will get better.”

“We are expecting them [costs] to increase.”

“They will increase the demand for our American-made products.”

“Likely to increase costs but outlook is clouded due to not having a clear direction from the Federal Government.”

“Not too much, due to access to local supply chain.”

“Will affect but I don’t know how much.”

“Depends on the new policies.”

“Hinder procurement and increase costs.”

“From European perspective there will be most likely a cost increase.”

“We produce in Europe. The future U.S. policies will not be friendly!”

“Do not see major change.”

“We expect relevant effects due to US trade policies.”

“We try to buy material in big stock at the beginning of the year.”

“In a positive way we expect.”

“Probably not at all.”

“It is too early to comment. It depends upon how Europe, the Middle East and Ukraine situations respond to the not-yet-clear Trump Policies. Oil prices and climate change issues will also come to the forefront.”

“Not at all.”

“I have no idea.”

“Unsure at this time. We use all American made products in our gear production. It will be interesting to see if demand will create shortages and allocation again. It could push prices up again for steel and other products.”

“2025 U.S. trade policies that have yet to be announced will likely put a damper on near-term growth and cause an increased costs. Trends will likely continue during the new regime’s policies.”

“Not at all.”

“Increase the cost of doing business.”

“I expect supply chain costs to increase.”

“Neutral.”

“Most likely decrease demand due to higher prices.”

“Depending on how the elected administration does, it could harm current customers.”

“We will do much better, even if cost of raw materials rises.”

“I believe (hope) costs will drop somewhat.”

“Increased cost of materials.”

“The business will remain similar.”

“Increased cost.”

“Negatively.”

“Uncertain on direct impact but likely neutral based on balance of positive and negative changes to our industry.”

“Potential tariffs could have a big impact. This is an unknown for now.”

“They will have a significant impact on supply chains and business costs due to tariff and protectionism policies and the regionalization of production.”

“High potential to have a substantial impact on my business.”

“Minimally.”

“In 2025 everyone will be passive and cautious. Effects will show up later.”

“Raw material prices will be adversely affected; may see some growth from domestic customers.”

“I think no impact.”

“Probably there is no good news in the coming months.”

“Costs will go up.”

“Minimal. Maybe raw materials.”

“Positive.”

“I expect supply chain and costs to continue to rise.”

“None.”

“I expect it will increase costs.”

“Don’t anticipate any negative effect.”

“HELP!”

“Will increase costs.”

“Should make the industry more competitive.”

“Positive.”

“They will increase, but not sure by how much.”

“I expect they will stay the same, as over 50 percent of or supply chain is in Northern Illinois and, of the remaining 50 percent, 40 percent is based in the United States.”

“Expecting increased input costs due to tariffs.”

“Tariffs will likely increase our cost for raw materials and some purchased parts.”

“Tariffs and the strong U.S. Dollar may force higher prices in the future. The strong USD hurts the global market for domestic suppliers.”

“Tariffs would have a significantly negative effect on our business.”

“Highly unpredictable but likely negative.”

Describe the importance of sustainability in your company’s overall strategy, including specific initiatives your company has implemented, if any.

“We have tried to digitize files.”

“Not much.”

“Not yet started.”

“Not much. We recycle when we can.”

“We have updated corporate literature, but it plays a minor role in product development and manufacturing operations.”

“Very important. Our customers are asking to comply.”

“I believe sustainability is important to my employer. We are always looking at manufacturing techniques that reduce consumables. We are designing products that will reduce greenhouse gases.”

“Sustainability becomes a more and more important aspect for the entire industry. We are developing an integrated management system in order to cover all requirements beyond a conventional quality management system.”

“Important topic. We meet all government requirements.”

“From the beginning our sustainability was based on original ideas and dedicated technology applications. The strategy will be the same: Do more with less.”

“This is of paramount importance. We have implemented a detailed plan with several actions ongoing. First of all, we did it because we believe in it. In addition this is becoming mandatory to work with certain companies and countries.”

“To maintain the ISO 14000, Reach and Rohs.”

“It is important. We have installed solar cells in our plant roof.”

“Most important concept.”

“It is an important topic. We have implemented ISO 14001 standards and installed solar power plant.”

“Nil.”

“Sustainability is going to become a bigger driving force in our company. We are being asked by our customers to become sustainable. We use returnable dunnage now with our customers.”

“Taken seriously.”

“Both finical and environmental sustainability have been ongoing since the 1980s.”

“We are focused on reducing our operations CO2 emissions through the purchasing and/or implementation of green energy.”

“Sustainability is a BAD Word here.”

“Global economies must improve to provide potential of sustainable development.”

“None.”

“We see CSR (corporate social responsibility) getting more embedded in the manufacturing sector. Large OEMs are demanding more carbon data, recycling data, energy consumption and efficiency data, etc…”

“It’s only going to get more prevalent.”

“Very important.”

“This is important for us. We are implementing a program.”

“Not important.”

“Part of our values: reclaim of material, energy reduction.”

“I have always tried to balance financial sustainability and environmental sustainability. This month I celebrate 50 years of being self-employed doing machine work and welding at the same location.”

“Focus and investment on hybrid technologies to help customers improve efficiency.”

“Sustainability is in the forefront. However, it takes a back seat as technology for sustainability is not there yet.”

“There are some specific initiatives that we have implemented energy efficiency, waste reduction and education and awareness.”

“It is important.”

“It will become more important to our customers. Measures are available but are too expensive to sell them right now.”

“Neutral. Limited focus beyond simply not being wasteful.”

“Sustainability is very important in my company. We are focusing on a new product most suitable for the new drive of vehicle.”

“Very important. We will change out heating system and install solar panels this year.”

“Heading in that direction. Looking at ISO14001.”

“Very important.”

“We are actively looking at ways to decrease our carbon footprint and energy costs through the use of solar panels and other energy saving initiatives, but they need to make sense for a return on investment.”

“Highly important.”

“Top priority.”

“Our company has continuously operated with a focus on our environmental impact.”

“There is no national policy support for U.S. gear train development.”

“We supply renewable technologies as an important piece of our customer base.”

What role will emerging technologies (including, but not limited to IIoT, additive manufacturing, robotics, automation and artificial intelligence) play in your organization in the coming years?

“Small.”

“Automation, Automation, Automation... We are trying to implement automation in all areas where it’s possible.”

“Need to implement IOT in the future but no definite timeline.”

“Increase in robotics.”

“We are already active in IIoT, need to have more standardization (rating practices) before additive manufacturing becomes useful.”

“Slowly implementing some where there are benefits from such technologies.”

“IoT and Robotics will be developed more and more.”

“Very important role because the technologies are rapidly changing.”

“Little to none.”

“Don’t know. We are currently using additive manufacturing in our test lab.”

“AI will change the working world for all of us. Mainly seen positive as a support in daily business. However, there are numerous risks. Other emerging technologies have a limited effect on the heavy industry gearbox manufacturing.”

“We do not have this topic dealt with in our Industry, but I believe it will be irrelevant. High costs are part of the impediments to this.”

“Target is to maximize technology over operator capabilities.”

“We are very much engaged with automation that we expect to play a key role to partially offset the labor cost.”

“We are working on different coating technology like HiPIMS.”

“It is important and we are working on it.”

“We will have to upgrade out test facilities and add futuristic tech and knowhow.”

“IIoT is one of very important things to manage all industrial process. It will not die.”

“Those are currently important to our production. We are looking to bring IIoT in this year. We look at robotics, AI, and automation for any purchase of equipment. We have some of those in place now. Incorporation of 3D has many options for us now and the future from workholding design to prototype.

Labor is typically the number one cost of a company. If labor can be replaced through other means I expect our future workforce will look very different than it does today.”

“Will increase opportunities for us to aid in the design of advanced gear systems.”

“We use 3D printing and robotic welding some now. As a low volume (1 to 10 of a part number) manufacturer, robotics and many other forms of automation don’t work.”

“It is one of the most important issues to take into account for having better business.”

“Adoption of AI is a fundamental part of our business strategy across all facets of our business. We expect to continue investigating ways to increase competitiveness and reduce cost through the application of new technologies.”

“Emerging technologies is like counting your chickens before they’ve hatched.”

“They are requirements for success.”

“None. It doesn’t work for our business model.”

“It will continue to increase.”

“Robotics and artificial intelligence.”

“No primary role.”

“We are currently researching these technologies. They will be instrumental in our manufacturing business.”

“Additive manufacturing is currently being reviewed for continued applications along with automation.”

“None.”

“We will work on predictive maintenance.”

“Growing exponentially.”

“I hope our product knowledge software provides a way to make my experience and knowledge available to others so they don’t have to pay for learning what I have already paid for.”

“Additive manufacturing projects are under investigation along with IIoT but implementation expected to be relatively slow.”

“Continue to look for more opportunities for automation.”

“Machine improvements will likely have a bigger impact than emerging technologies.”

“Here I think we will only implement robotics.”

“Significant impact that will require increased capital spending to benefit from these new technologies.”

“Heavy on automation and AI.”

“AM is a primary business stream; no others will be impactful in the near term.”

“The new technologies will play bigger roles especially robotics and automation. Two reasons: decreasing labor market and lower prices of robots and automation.”

“I think AI will be important at our company.”

“Additive manufacturing.”

“Hopefully a very big role.”

“Maybe 5-8 percent overall contribution.”

“Robotics and automation (lights out) are key strategies for us in the short term. We will be exploring AI and how we can potentially use this for quoting / estimating / planning / programming in the future.”

“I suspect these emerging technologies will distract my organization from doing what needs to be done for our recovery and to meet growing demands.”

“None.”

“We do not make use of this tech.”

“It will continue to grow at a steady pace.”

“Not very much as we are a large job shop.”

“Big role.”

“Robotics and automation will become an important part of our organization.”

“Significant as we move more into production.”

“Huge.”

“Every change in technology affects our products, how our customers use them, and what their expectations are. This is true in established as well as emerging markets.”

“I believe that 3D printing will come to play a larger role in how we supply parts to our customers, manufacture legacy components, and develop concepts for tooling/workholding/machines. I believe that robotics and automation will need to be more than just a ‘Yes, we can do that,’ and will become almost standard with every machine that we offer. I see AI helping to solve challenges with programming, coding, and other tasks more effectively in the coming years as well.”

“Increasing the use of robots.”

“Additive manufacturing is likely to be used to create mockups. Other emerging technologies are not likely to see widespread adoption.”

“Limited.”

“Increasing use.”

“Automation and AI are targeted to solve our HR issues.”

“We hope to employ robotics in our operations and supply gearing to robotics companies.”

“We need to get to minimum set approach as now used by the chip industry.”

“Very important, particularly digital manufacturing and automation.”

SURVEY DEMOGRAPHICS

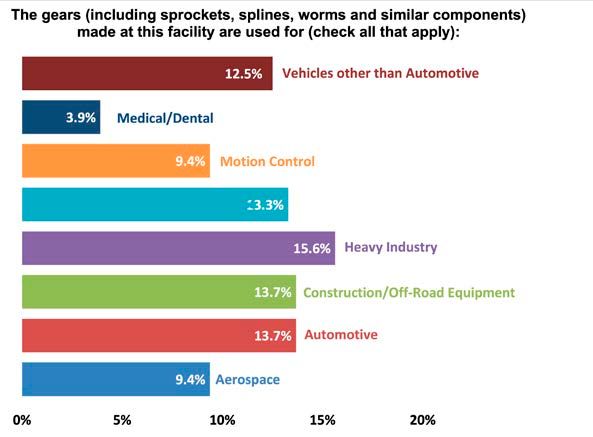

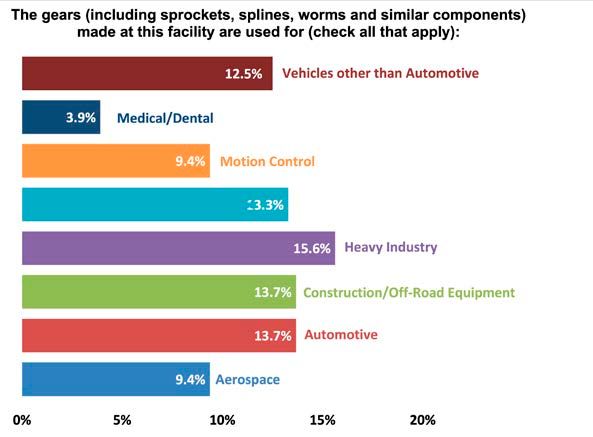

Industries

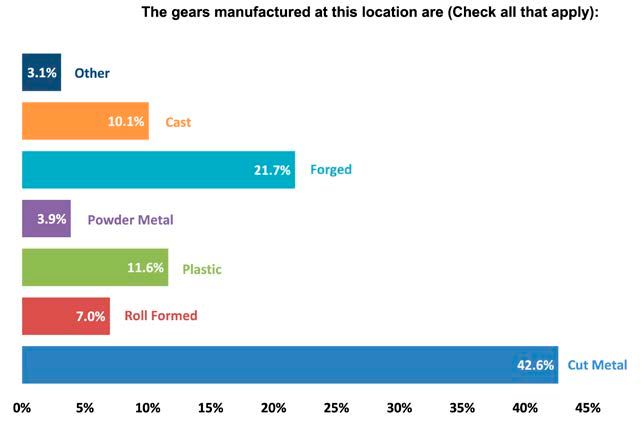

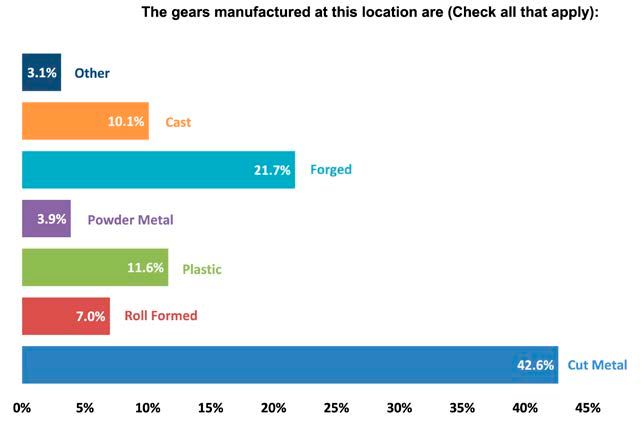

Gear Materials

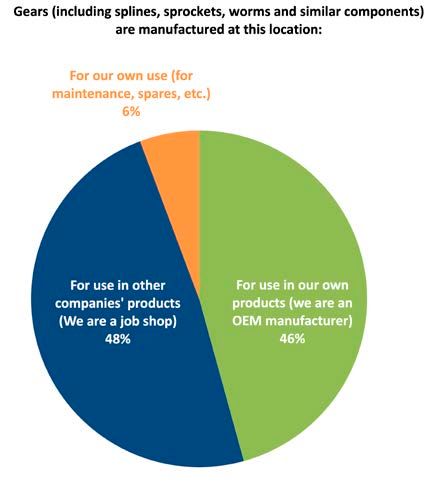

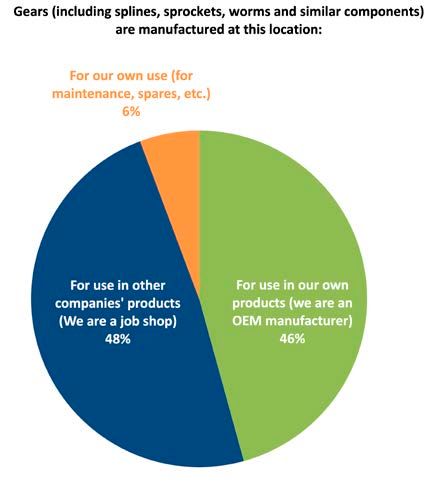

Type of Gear Manufacturer

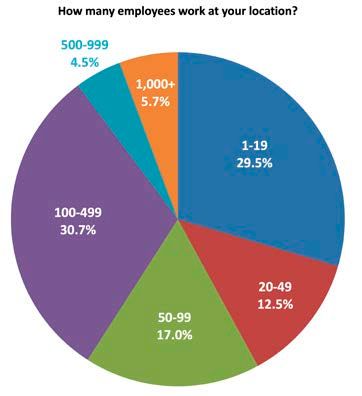

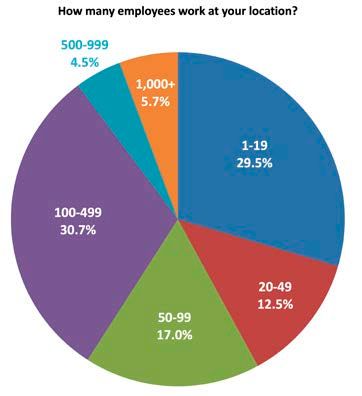

Number of Employees

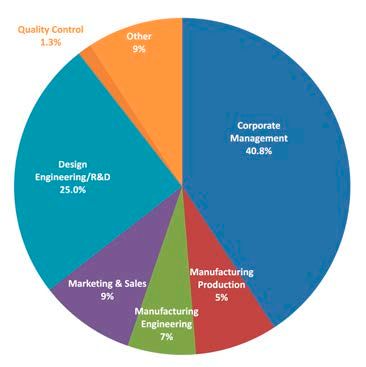

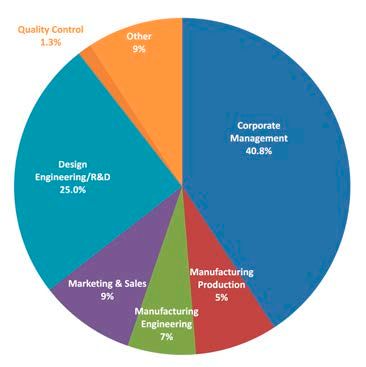

Job Title

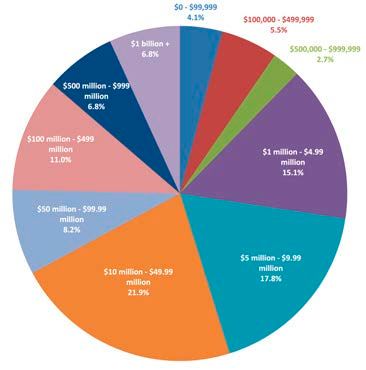

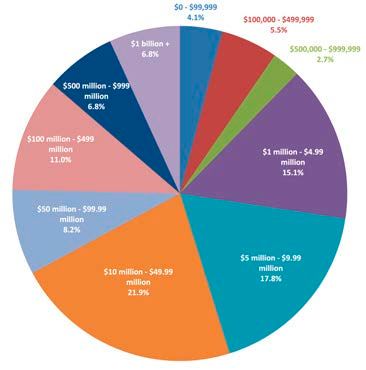

Annual Revenue

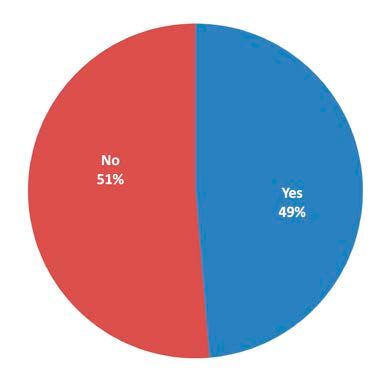

AGMA Membership