2014 State of the Gear Industry

2014 State of the Gear Industry

Reader Survey Results

Gear Technology's annual State-of-the-Gear-Industry survey polls gear manufacturers about the latest trends and opinions relating to the overall health of the gear industry.

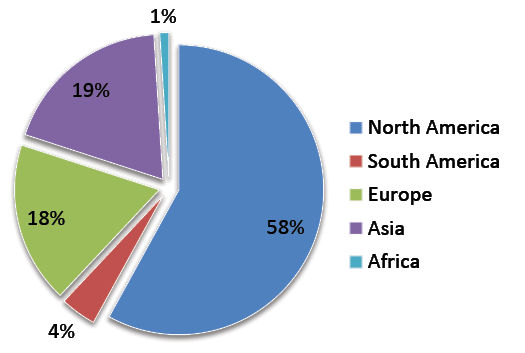

As in years past, the survey was conducted anonymously, with invitations sent by e-mail to gear manufacturing companies around the world.

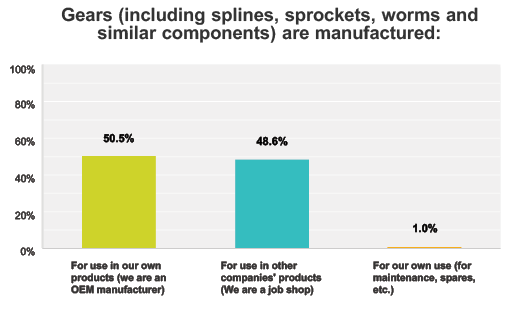

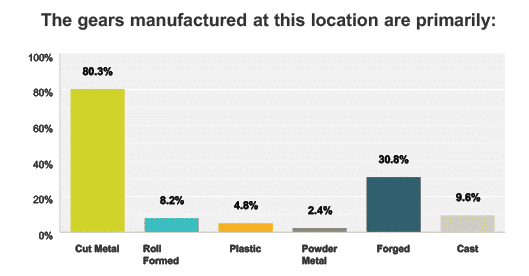

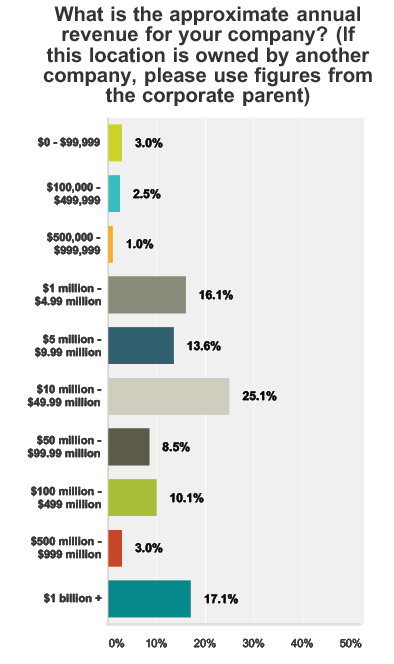

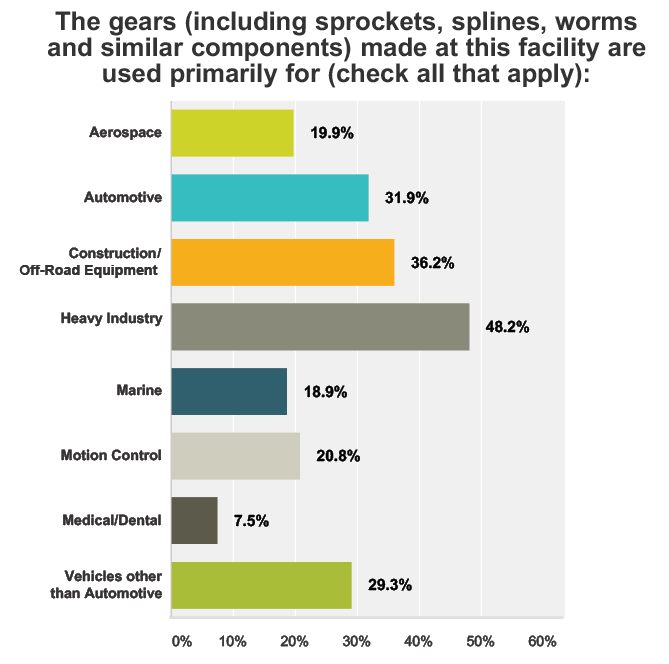

More than 300 individuals responded to the online survey, answering questions about their manufacturing operations and current challenges facing their businesses. All of the responses included in these results come from individuals who work at locations where gears, splines, sprockets, worms and similar products are manufactured. They work for gear manufacturing job shops, captive shops at OEMs and end user locations.

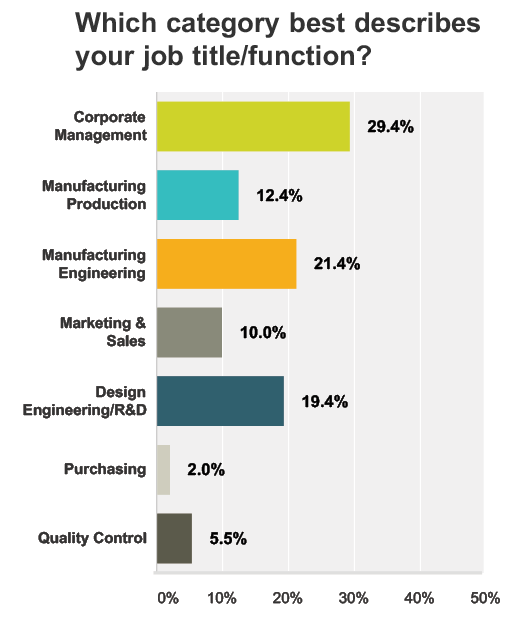

A full breakdown of respondent demographics can be found at the end of this article.

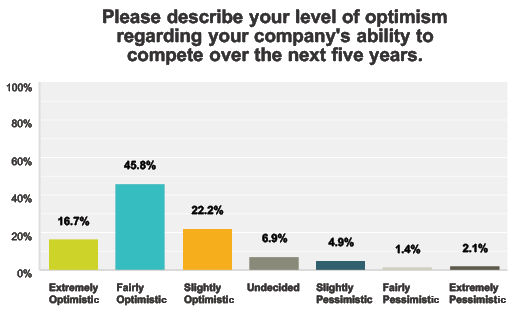

Gear Industry Optimism - Depends on Where You Are

Over the past nine years, approximately 89% of respondents indicated some level of optimism regarding their companies' ability to compete.