Overall there are three main drivers of

the reshoring trend. First are rising offshore

wage rates. Second is an increased

recognition of the previously ignored

costs, risks and strategic impacts of offshoring.

This recognition is enabled by

the use of the refined metrics of total

cost of ownership (TCO) to quantify

these factors. Third is a reduction of

costs through sustainable strategies such

as design for manufacturability, innovation,

automation and lean.

Using TCO is the first step a company

should take when evaluating sourcing

options. TCO is defined as the total of

all relevant costs associated with making

or sourcing a product domestically

or offshore. TCO includes current period

costs and best estimates of relevant

future costs, risks and strategic impacts.

TCO analysis helps companies objectively

quantify, forecast and minimize

total cost. It takes into account transportation

costs, travel expense and time,

carrying cost of inventory, warranty,

IP loss, impact on product innovation,

and many other factors such as those

associated with the risk of supply chain

shocks or disruptions caused by natural

disasters, political unrest and dock slowdowns. It also helps to forecast the future

impact of wage and currency changes.

Much of companies’ efforts to deal

with complex global supply chains is

eliminated or drastically reduced by

reshoring. Longer-term forecasting,

monitoring of suppliers and regulatory

compliance offshore is found to be waste

when measured against the use of proven,

local suppliers.

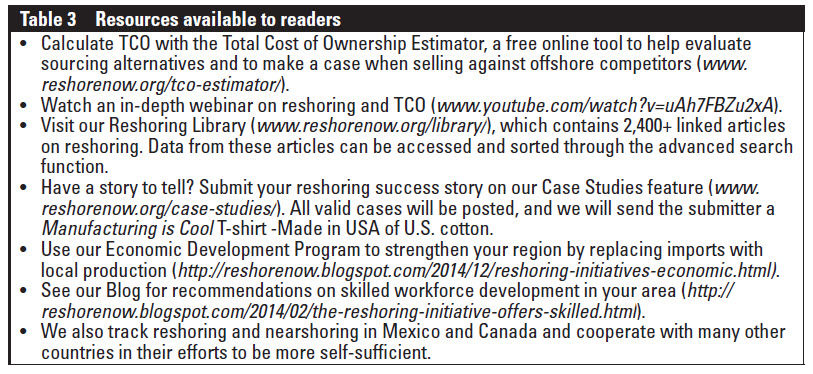

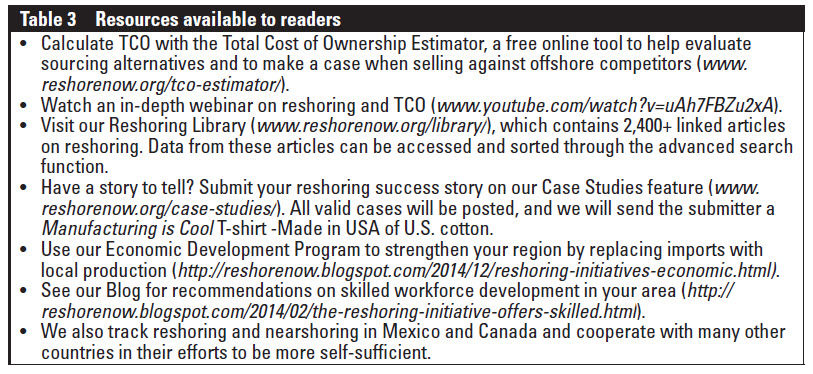

The not-for-profit Reshoring Initiative

offers the free TCO Estimator, available

on reshorenow.org. The initiative offers

many resources to help companies make

sourcing decisions (Table 3). Reshoring

tools can also be used by gear salesmen

to convince customers of the benefit of

sourcing domestically, especially for custom

gears.

Below are some examples of gear makers

who have chosen U.S. production or

sourcing over offshore.

- Bison Gear and Engineering Corp.

moved production of electric motors

and gears from China to St. Charles,

IL, creating 10 jobs.

–Reasons: Cost, quality, lead time and

lean manufacturing

- Pequea Machine Inc. brought production

from China to the U.S., bringing

contract work to Buck Co. (PA

foundry) and Circle Gear (IL machine

shop), and creating up to 20 new

future jobs (Ref. 1).

–Reasons: Quality (25% of gear boxes

from China failed due to substandard

metals used); equivalent price

(cost was about $900 to produce

gearboxes in the United States, and

between $800-$900 in China); Total

cost

- ZF Group, a Supplier for Chrysler,

brought production from Germany

to Gray Court, SC and Detroit, bringing

1,650 jobs in South Carolina, and

some additional jobs in Michigan. ZF

originally began building gearboxes

for wind turbines in Gainesville, GA

with a $98 million investment, adding

250 jobs.

–Reasons: Time to market, proximity

to market

- Metem Corp., which makes gas turbines

and aerospace industry products,

is expanding its Parsippany, NJ

plant over plants in Pennsylvania and

Hungary. Metem’s CEO on the company’s

growth: “One of the great things

about gas turbines is that the U.S.

really has a leadership position in that

technology. We are seeing our customers bring turbine manufacturing back

to the U.S. from other parts of the

world.”

–Reasons: Highly skilled workers,

access to universities, advanced

manufacturing

Conclusion

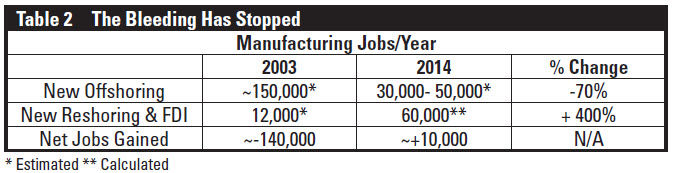

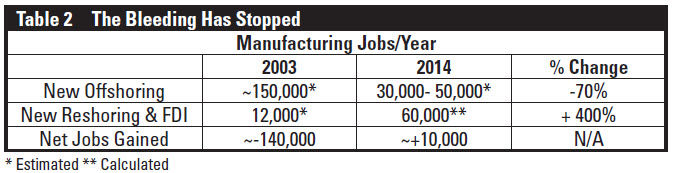

The Reshoring Initiative publishes data

(Ref. 3) annually to show that the current

trend in manufacturing for the United

States market is to source domestically.

With 3–4 million manufacturing jobs

still offshore, we see huge potential for

even more growth and hope this data

will motivate more companies to reevaluate

their sourcing and site selection

decisions. Making better-informed decisions

through the use of TCO and gaining

a competitive advantage through

sustainable strategies will enable U.S.

companies to locate more manufacturing

closer to home and strengthen the U.S.

economy.

We would like to build on the reshoring

momentum achieved at the AGMA

meeting. We have outlined (Table 3) our

tools and programs that you can use.

The best way to accelerate the trend is

to document and promote the successful

cases. Therefore, we especially encourage

you to report the cases where you

reshored, where you directly replaced

an imported gear source or where your

customer brought back product assembly

and sourced gears from you. Reports

can be made on our Case Studies feature.

The resulting PDFs will be posted on the

Reshoring Initiative website, and you can

post on your site. Case submitters also

receive a Manufacturing is Cool T-shirt,

made in the USA of U.S. cotton.

References

- www.themadeinamericamovement.com/uncategorized/

pequea-machine-joins-the-reshoringmovement-

reshores-part-production-for-betterquality/.

- www.njbiz.com/article/20130130/

NJBIZ01/130139989/Manufacturer'sexpansion-

in-Parsippany-expected-to-create-jobs-

CEO-says.

- www.reshorenow.org/content/pdf/2014_Data_

Summary.pdf.

About Author

Harry Moser founded the

Reshoring Initiative to bring

manufacturing jobs back to the

United States after working

for GF AgieCharmilles, starting

as President in 1985 and

retiring at the end of 2010 as

Chairman Emeritus. Previously

he worked for Disamatic U.S. for six years.

Largely due to the success of the Reshoring

Initiative, Harry was inducted into the Industry

Week Manufacturing Hall of Fame 2010 and was

named Quality Magazine’s Quality Professional

of the Year for 2012. Moser participated actively

in President Obama’s January 2012 Insourcing

Forum at the White House, won the January

2013 The Economist debate on outsourcing and

offshoring, and received the Manufacturing

Leadership Council’s Industry Advocacy Award

in 2014. He received a bachelor’s degree in

mechanical engineering and a master’s degree

in engineering from MIT in 1967, and he earned

an MBA from the University of Chicago in 1981.