Non-Automotive Robots Surpass Automotive Orders in 2020

For the first time, yearly orders of robots from non-automotive sectors surpassed automotive robot orders, as sales of robotic units in North America increased 3.5% in 2020 from 2019. This growth was driven by a strong Q4 that was the second-best quarter ever for North American robotic sales with a 63.6% increase over Q4 2019.

Industry statistics – released by the Robotic Industries Association (RIA), part of the Association for Advancing Automation (A3) – show that North American companies ordered 31,044 robotic units, valued at $1.572 billion in 2020. In Q4, companies ordered 9,972 units valued at $479 million.

“The surge in robot orders that we’re seeing, despite the pandemic, demonstrates the growing interest in robotic and automation solutions,” said Jeff Burnstein, A3 President. “It’s promising to see the growth of robotics in new applications and reaching a wider group of users than ever before.”

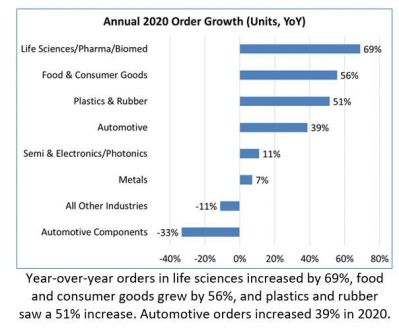

Year-over-year orders in life sciences increased by 69%, food and consumer goods grew by 56%, and plastics and rubber saw a 51% increase. Automotive orders increased 39% in 2020.

“In 2020, we saw two trends in particular that propelled growth in non-automotive orders for robotics technology,” said John Bubnikovich, chief regional officer – North America, KUKA Robotics. “First, the automation competence level in general industry has grown, and that matured into greater demand for the technology. Second, consumer behavior shifted significantly and the expectations created by this shift were tough to satisfy without automation.”

At the same time, Bubnikovich said, supply chain disruptions and instability in the workforce made industries accelerate automation strategies.

The same trends are being noticed by other major robot manufacturers.

“With the changes in people’s personal buying behavior caused by COVID, robots have been utilized in record numbers to allow for the fulfillment of orders in the e-commerce space while allowing for correct social distancing practices,” said Dean Elkins, segment leader – handling, Yaskawa Motoman. “In addition, robots largely aided in the production of personal protection and testing equipment and the medical devices needed to keep our society healthy and safe.”

“We have seen a substantial increase in activity in non-automotive sectors, as customers focus on making their production lines more flexible and better able to efficiently achieve high mix, lower volume production in response to constantly evolving customer demands,” says Mark Joppru, vice president – consumer segment and service robotics, US ABB Robotics and Machine Automation. “In food applications, for example, where robots were traditionally used to automate simpler processes like case loading, they are increasingly being commissioned for higher value processes, like directly preparing food, resulting in improvements to food safety and hygiene. While these trends have existed for several years, COVID has changed perceptions and priorities for customers, accelerating the adoption of robotic automation.”

In August of 2020, A3 reported on the strain to supply chains and economic uncertainty due to COVID-19. Alex Shikany, A3 Vice President, Membership & Business Intelligence, noted that despite a drop in orders, industry leaders showed optimism about the remainder of 2020, and accurately predicted the strong finish to 2020.

“The pandemic has created a sense of urgency for manufacturing companies to invest in automation like never before,” said Mike Cicco, president and CEO of FANUC America. “Traditionally, companies have implemented automation to reduce cost, increase output, and improve quality. However, the pandemic has added an additional factor that is driving manufacturers to re-examine their supply chain to increase flexibility, minimize disruptions, and move it closer to their customers. With this mindset, there are more opportunities for scaling robotic applications across multiple facilities, especially for larger companies. The untapped potential for automation is a promising sign for our industry; the opportunities for automation today are truly limitless.”