Decarbonization of the Iron and Steel Sector: Challenges and Opportunities

With government mandates to reduce greenhouse gas (GHG) emissions, decarbonizing the largest industrial emitters has become an essential research focus. The Environmental Protection Agency (EPA) reported that industrial point sources in the United States (U.S.) emitted 1.45 billion tons of carbon dioxide (CO2) in 2022, accounting for 23 percent of all domestic CO2 emissions for that year (Refs. 1,2). One of the largest contributors to industrial emissions is the iron and steel industry, which was responsible for 2.5 percent of total U.S. GHG emissions in 2023 (Ref. 3). Due to the large quantity of emissions available for capture from this industrial sector, iron/steel production facilities present an impactful opportunity for industrial decarbonization.

Various CO2 capture technologies can be deployed in the iron/steel industry, including post-combustion capture with chemical solvents or membranes, precombustion capture with chemical solvents or membranes, and capture via calcium looping. There exist various examples of efforts to advance the decarbonization of iron/steel plants. The only operating, commercial-scale CO2 capture plant in the iron/steel industry is the Al Reyadah facility in the United Arab Emirates (Ref. 4). This plant, commissioned in 2016, was initiated as a joint venture between Abu Dhabi National Oil Company (ADNOC) and Masdar, and captures CO2 from a direct reduced iron (DRI)-based steel plant (Ref. 4). The capture plant has a nominal capacity of 800,000 tons of CO2 per year and ADNOC asserted in 2023 that the plant enabled capture of 45 percent of emissions from DRI production (Ref. 4). The approximately 89 percent pure CO2 product is dehydrated and used for enhanced oil recovery (EOR) in ADNOC’s onshore oil fields (Ref. 4). In the U.S., the U.S. Department of Energy (DOE) has sponsored front end engineering design (FEED) studies, pre-FEED studies, and pilot demonstrations examining the addition of capture to iron and steel plants. This includes a pre-FEED study led by Dastur International Inc. in coordination with Cleveland-Cliffs Inc. assessing the implementation of ION Energy’s solvent-based, post-combustion capture technology to capture 95 percent of CO2 from blast furnace (BF) flue gas from a steel plant located in Burns Harbor, IN, producing 5 million (M) tons of steel per year. A DOE-sponsored FEED study led by The University of Illinois, in partnership with Air Liquide, Visage Energy Corporation, Hatch Associates Consultants Inc., Midrex Technologies Inc., ArcelorMittal, and voestalpine Texas LLC, is examining the use of Air Liquide’s Cryocap technology to capture 95 percent of the total CO2 emissions from a Texas hot briquetted iron plant.

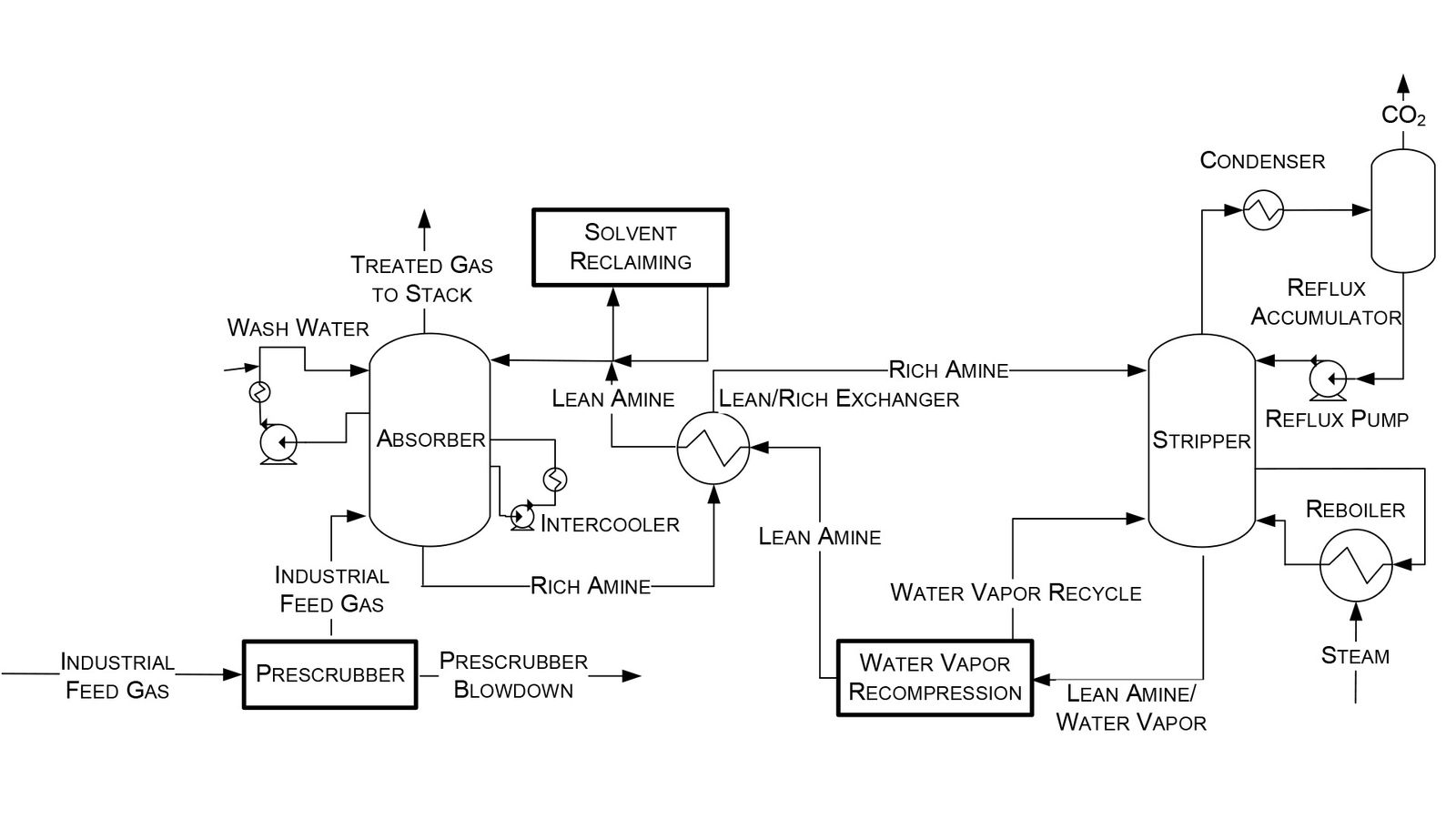

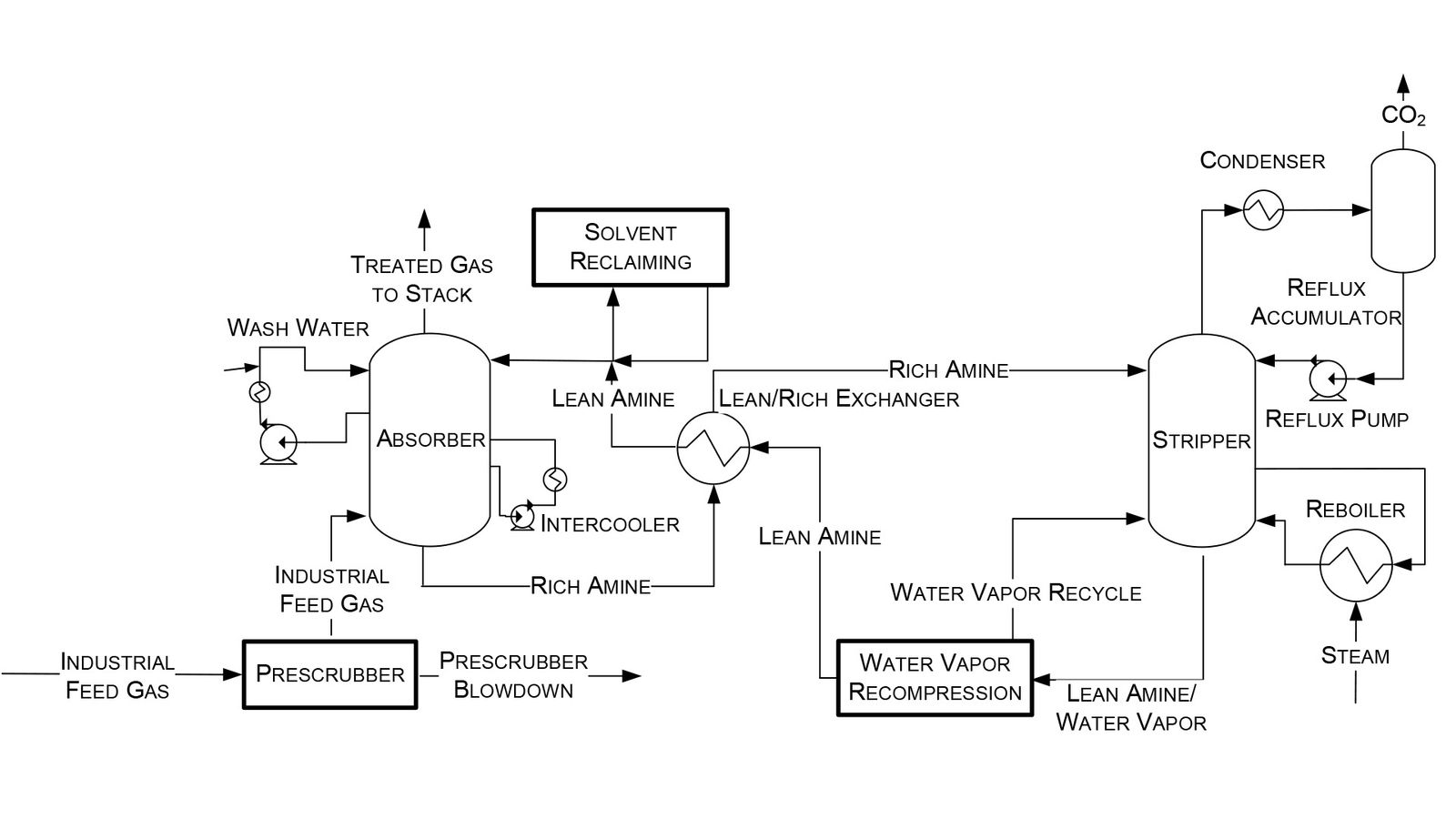

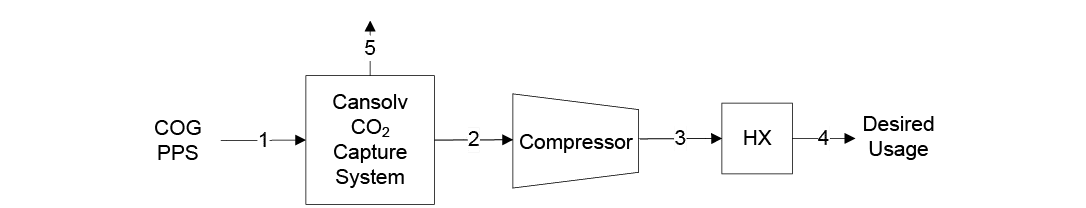

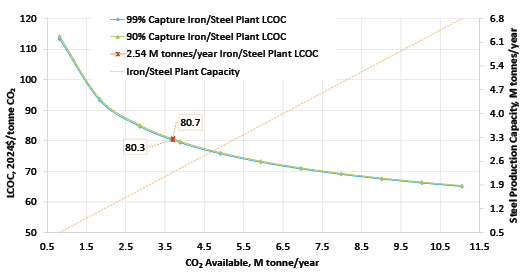

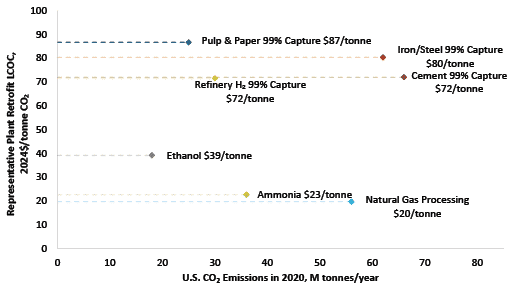

In 2023, the National Energy Technology Laboratory (NETL) released its report, “Cost of Capturing CO2 from Industrial Sources,” (Industrial Sources Report) intending to estimate the levelized cost of CO2 captured (LCOC) from selected industrial processes including iron/steel facilities (Ref. 5). A traditional pathway to produce steel from iron ore comprising a BF integrated with a basic oxygen furnace (BOF), also referred to as an integrated steel mill, is considered for this analysis. While integrated steel mills have multiple CO2 emissions sources, this work focuses on applying capture to the three largest and highest concentration sources. The capture system utilized is the CANSOLV CO2 capture technology commercially offered by Shell. CANSOLV is an amine-based, acid gas removal (AGR) process designed to recover high purity CO2 from dilute flue gas streams and is assessed at capture rates of both 90 and 99 percent. The LCOC for this system is estimated using the methodology established in NETL’s Quality Guidelines for Energy System Studies (QGESS) document, “Cost Estimation Methodology for NETL Assessments of Power Plant Performance” (Ref. 6). NETL’s 2023 Industrial Sources Report presents the LCOC in December 2018 dollars.

The current paper leverages the Industrial Sources Report’s iron/steel cases, expands the discussion, and provides the LCOC in January 2024 dollars. The financial assumptions are updated with input from NETL’s Energy Markets Analysis Team and are based on 2024 iron/steel industrial sector market data.

Background

Iron/Steel Production Methods

There are two commercial methods of iron production in operation today: the blast furnace (BF) method and direct reduced iron (DRI) method. In the BF method, coke and sintered iron are fed to the top of the BF while hot blast gas is fed through the side. Coke is oxidized to form CO2 which subsequently reacts with more coke to produce carbon monoxide (CO). This CO facilitates the reduction of iron oxides to form pig iron, a high carbon iron alloy. In 2023, the U.S. produced 20.6 M tons of pig iron and imported an additional 4.4 M tons (Ref. 7). The DRI method is a newer alternative iron production pathway. DRI is made by reducing iron ore with gas, eliminating some pre-processing steps required for BF operation (Ref. 8). Typical reductants used to make DRI are coal syngas, natural gas, or hydrogen (H2) depending on availability. In 2023, DRI production constituted 5.2 M tons of iron production in the U.S. (Ref. 7).

Steel is produced by reducing the carbon content of iron in a furnace, of which there are two types in commercial operation. Traditionally, a BOF is used to remove carbon by blowing hot oxygen through molten pig iron. A newer alternative is the electric arc furnace (EAF), which uses electricity to melt scraps and recycled steel to form a steel product. While scrap and recycled steel is considered the main feed for EAF mills, some have been configured to use feeds of pig iron or DRI (Ref. 8). As of 2023, 31.7 percent of U.S. steel was produced via EAFs, with the remainder produced via BOFs (Ref. 7).